What‘s Fueling High Diesel Prices?

July 13, 2022

Today’s record-high diesel prices are a serious global issue. Reduced output from refineries, international conflict, and unstable market conditions are just a few of the factors driving up the price of fuel. Even under more normal circumstances, understanding all the variables that contribute to the price at the pump can be a challenge.

“I think the first thing to remember is that historically, diesel has always been more expensive than gasoline—sometimes sixty to seventy cents per gallon more,” says Joe Lombardo, President and Founder of ége avenue associates.

Lombardo points to three primary causes for current diesel costs.

- diesel fuel is taxed at a higher rate than regular unleaded by the federal government (24 cents per gallon for diesel compared to just 18 cents per gallon for regular).

- global demand for diesel is big, as the rate of personal vehicles that run on the fuel in other nations is higher than in the US market.

- diesel is more costly to refine and produce compared to other types of fuel.

Are international pressures to blame for rising diesel costs? Find out in this week’s episode of the Stay In Your Lane Podcast.

A steady decrease in domestic refining capacity has also contributed to the uptick in diesel prices. According to Lombardo, there are currently just 124 refineries capable of producing diesel across the US today, compared to over 250 at the peak in the 1980s. This troubling trend could be accelerating. In 2016, there were 135 operating refineries—that’s a loss of 11 refineries in just 5 years.

Boosting the domestic supply of diesel isn’t as simple as opening more refineries. The permit process to open these facilities can be daunting, and once open, refineries are among the most expensive assets for oil companies to operate. Since they run on extremely tight margins, it is tempting for companies to shut down refineries that fail to operate consistently above 95% capacity.

Even with adequate refineries running at peak capacity, a steady supply of crude oil is needed to produce all types of fuel. But a plentiful stockpile of crude oil does not necessarily equate to a surplus of diesel.

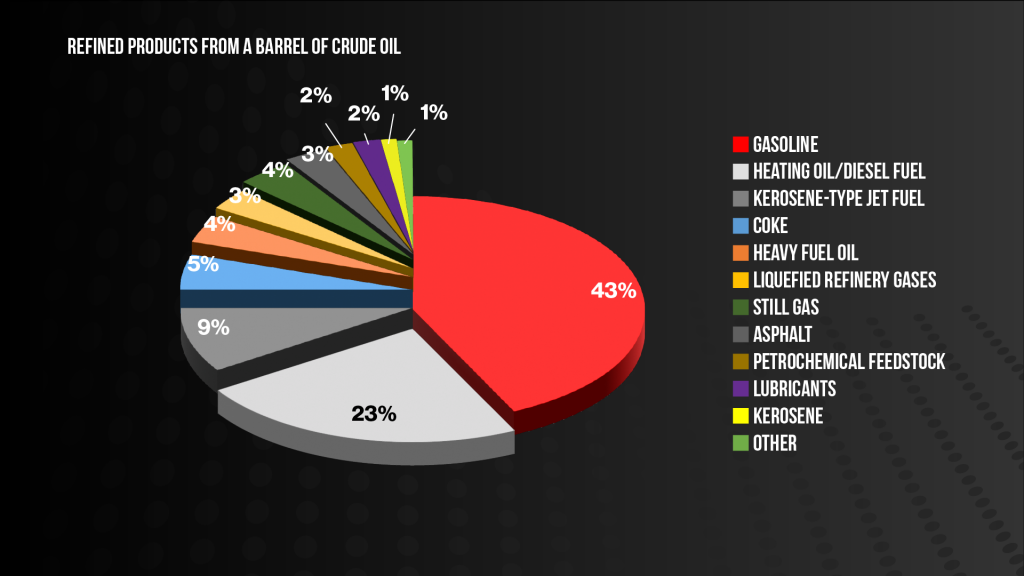

“In a barrel of crude oil, which is 42 gallons, there are probably a dozen different products that can be made from that,” explains Lombardo. “It’s not all gasoline or all diesel, it’s various products.”

Gasoline is the largest product taken from a gallon of crude at around 19 gallons, or 43% of a barrel. Among the many other products produced including lubricants, heating oil, asphalt, and more, diesel accounts for around just 12% of the output per barrel of crude.

What factors control the price at the pump for diesel and other fuels? Learn more in the latest episode of the Stay In Your Lane Podcast.

Diesel makes up a small portion of the refinable product even when crude is abundant. The petroleum industry has moved away from a model that incentivizes general profitability rather than the drilling of new oil wells. This shift could also help to account for the lower number of refineries and the overall lower stock of fuel.

Like many commodities, the global supply of diesel is subject to the tides of geopolitics. The Russian invasion of Ukraine and the sanctions against Russia that followed have greatly decreased the availability of oil in the European and Asian markets. With the Russian supply cut off, the market feels the squeeze in the price of diesel internationally.

The high cost of diesel could have major economic impacts beyond just the transport industry. Consumer goods rely on trucks, trains, and other diesel-powered modes of transportation to reach their destinations. Higher fuel prices are rolled into the cost of products on store shelves to account for this increased overhead. With inflation already running high, it’s hard to see prices stabilizing without a dramatic decrease in the cost of diesel. This positions diesel prices as one of the potential instigators of a recession.

Fuel prices rise rapidly and are typically slow to decrease. In these uncertain times, it’s all but impossible to forecast the future cost of diesel. However, there is one thing you can always depend on: the best possible third-party logistics services from your partners at Triple T Transport. Learn more about how we help support our customers and their fuel budgets.

Special thanks to Joe Lombardo for contributing to this article. To learn more about Ege Avenue Associates, visit their website at www.egeavenue.com.